Cheapest Home Loans

No down payment reduces up-front costs.

The down payment is often the biggest up-front expense for home buyers. Most conventional lenders require a down payment of at least five and sometimes 20 percent. On a $200, 000 home, that down payment could range between $10, 000 and $40, 000.

Enter the VA loan: one of the only mortgages that doesn’t require a down payment. Eligible buyers can choose to finance 100 percent of a home (within a VA lender’s guidelines), and bypass a substantial down payment.

Don’t mistake “no-down-payment” financing with “less expensive” financing. A no-down-payment loan isn’t “cheaper.” Buyers do end up paying more interest over the long run. But that tradeoff can prove worthwhile for eager buyers without a large chunk of cash.

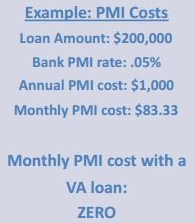

No PMI cuts long-term costs.

VA loans also let buyers sidestep PMI. PMI (private mortgage insurance) is typically required when borrowing more than 80 percent of a home’s value. The fee for PMI is tacked onto a monthly mortgage payment, and usually ranges between .5 and 1 percent of the total loan amount.

Since a portion of VA loans are backed by the federal government, VA lenders do not ask borrowers to buy PMI. It’s a handy perk that cash-strapped homeowners quickly come to appreciate.

Since a portion of VA loans are backed by the federal government, VA lenders do not ask borrowers to buy PMI. It’s a handy perk that cash-strapped homeowners quickly come to appreciate.

Closing costs are low and can be paid by the seller.

The VA strictly regulates the type and amount of closing costs that can be paid by VA loan borrowers. That oversight keeps closing costs in line with, and sometimes below, conventional closing costs.

Competitive interest rates keep payments low.

One of the biggest determinants of a loan’s interest rate is the amount of risk involved with the loan.

The government backing provided with each VA loan lessens a lender’s risk. Less risk gives lenders greater flexibility with interest rates. As a result, VA loan interest rates can often feature lower interest rates than conventional mortgages.

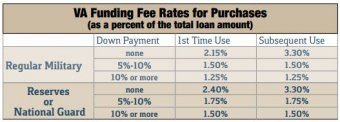

Don’t forget the VA Funding Fee.

VA loans do incur one unique cost: the VA Funding Fee. The VA Funding Fee offsets the VA’s administrative costs, and ranges in value from 1.25 to 3.3 percent of the total loan amount (veterans with a service-connected disability are sometimes exempt).

Keep in mind that the Funding Fee doesn’t have to be paid up-front. Military buyers can choose to roll the fee into the total loan amount.

At the end of the day…

Is a VA loan cheaper than other loan options? Maybe. Maybe not. Every buyer, seller, purchase and lender are different. It’s impossible to say that one loan program will ALWAYS be cheaper than another.

But with a plethora of low-cost benefits, VA loans definitely have a shot at being the cheapest way for eligible buyers to finance a home.

To find the best financing tool for you, talk to an experienced loan officer. Make sure your lender has experience with different lending programs (VA, FHA and conventional), and can provide a comprehensive assessment. Buyers can reach a Veterans United loan specialist 24/7 by calling 855-524-7279 or via VeteransUnited.com.