Mortgage for house abroad

Generally speaking, the purchase of property (foreign or domestic) generally needs not be reported on your US expat taxes, unless there is some sort of Homebuyer’s Credit in place for the related year. When a US citizen’s primary residence is sold, however, the resulting gain or loss will need to be reported on Schedule D of the taxpayer’s US expat taxes. For this reason, it’s important to retain very good documentation regarding the original purchase and associated costs of the property.

However, real estate transactions in foreign countries are handled differently than US transactions. For this reason, it’s important to research the applicable laws and insurance requirements for your new host country. You will also find it beneficial to obtain a bank account in your host country to assist in the payment and management of your foreign mortgage, and other expenses such as property taxes. Your ownership interest in this foreign bank account could prompt the filing requirement of Form FinCEN 114, Report of Foreign Bank and Financial Accounts (FBAR). For more information on FBAR filing requirements, see our US Expat Taxes Explained series on our blog.

When you transfer money into your foreign bank account, be cognizant of the foreign exchange rates and fees associated with the transfer. When making the initial down payment on your foreign property, you could be transferring significant sums of money. Proper research and retention of a professional broker could save you thousands of dollars by ensuring that you are obtaining the most beneficial foreign exchange rate possible.

It’s also a good idea to consult with the US embassy in your host country for any assistance regarding local laws, property taxes, and other requirements before purchasing your new property. It’s possible that costs charged by government agencies, real estate agents, or legal advisors are significantly more than you might expect in a US real estate transaction. These expenses vary from country to country. It’s imperative to research and plan ahead as it can save money on your US expat taxes.

Mortgage interest and points will continue to be deductible on your US expat taxes, despite the property’s location in a foreign country. However, this information needs to be reported in US dollars, so it’s important to convert the amounts before claiming the deduction. For assistance in the preparation of your US tax return, the IRS website provides annual foreign exchange conversion rates for numerous countries, and links to a reputable third-party website with more detailed historical information.

US Expat Taxes and Selling Real Estate Abroad

The sale of your foreign property will have the largest impact on your US expat taxes. As a US citizen, the sale of your principal residence will prompt a gain or loss that is reportable on your tax return. However, if you have lived in this home for at least two of the last five years, then you will be eligible to exclude a gain of up to $250, 000 ($500, 000 for married taxpayers) from taxation. If you have not lived in the home for at least two out of the last five years, the gain will be taxed at capital gain rates. It is important to note that even if the gain does not qualify or is not wholly excluded, it will be considered foreign source income, and thus eligible for the reduction by the foreign tax credit. However, it will not be considered foreign earned income, and thus not excludable under the foreign earned income exclusion. To calculate the gain, each transaction will need to be converted to USD on the transaction date, rather than the sale date. All income must be reported in US dollars on US expat taxes.

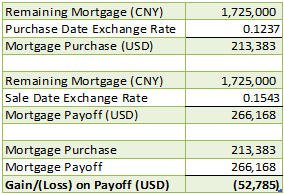

The other important transaction likely to result from the sale of a foreign residence is the gain or loss resulting from the foreign exchange rate conversion when the mortgage is paid off. The currency exchange gain or loss resulting from the payoff of the mortgage is considered personal. Thus, any resulting loss is not deductible. However, any resulting gain is taxable at ordinary income rates. If you have held the property for at least a year, you will qualify for the long term capital gain tax rate of 15%. Unfortunately, you cannot use the loss on the sale of the home to offset any currency exchange rate gain, and vice versa.

Example: John Expat

To assist in the explanation of the calculation of gains associated with selling your foreign primary residence, let’s discuss the sale of John Expat’s foreign residence. John moved to China in 2005, where he immediately began searching for a home to purchase. He found one, and on November 17, 2005, he signed the papers to purchase his new home. He paid 1, 865, 000 Chinese Yuan (CNY) for the property on the date of sale. On May 25, 2007, he paid 50, 000 CNY for new windows on the house. In 2011, he decided he wanted to move back to the US to spend time with his family and put his house on the market. He signed the closing papers on June 24, 2011, with a sales price of 2, 010, 000 CNY. At that time, he had 1, 725, 000 CNY left to pay on his mortgage.

Each transaction is converted to USD at the date the transaction occurred:

Because John owned and lived in the property for at least two of the last five years, he is eligible to exclude the entire gain associated with the sale of his principle residence.

It will take more USD to pay off the foreign mortgage than originally anticipated at the date of purchase. The result is a net loss of $52, 785 USD. Unfortunately, this loss is not deductible on John’s US expat taxes.

The total impact to John’s US expat taxes resulting from the sale of his Chinese principle residence is zero. He is able to exclude all of the gain associated from the sale of the property, and he incurred a loss on the currency exchange associated with the mortgage payoff which cannot be applied to his other foreign income.

Questions About Real Estate and US Expat Taxes?

If you are going to be buying a residence overseas, it is wise that you discuss your options with your host country’s US embassy, consult multiple international real estate brokers and discuss your options with an expat tax expert. Doing so will allow you to know exactly what to expect from your purchase of a home overseas and avoid any unpleasant surprises on your US tax return.