February 12, 2017

Home Loan Assistance Programs

PROGRAM INFORMATION

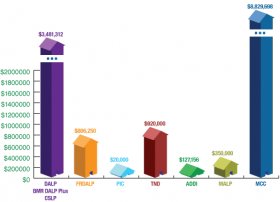

- First Responders Downpayment Assistance Loan Program (FRDALP) - Provides downpayment assistance loans to active uniformed, sworn members of the San Francisco Police Department (SFPD), San Francisco Fire Department (SFFD) and San Francisco Sheriff's Department (SFSD) to purchase their first home in the City and County of San Francisco.

- Downpayment Assistance Loan Program (DALP) - A loan program for low to moderate income first time homebuyers purchasing a market rate single family home in San francisco. DALP is a silent second loan that requires no payments for 30 years.

- City Second Loan Program - A loan program for eligible first time homebuyers purchasing a home within specific developments that has no interest and deferred payment. This loan sits in second position on title after the first mortgage and can be repaid at any time without penalty.

- Teacher Next Door Program (TND) - A loan program to assist teachers employed with the San Francisco Unified School District in purchasing a first home in San Francisco. This loan is forgiven after 10 years provided all program requirements are met. Can be used in the purchase of a BMR unit.

- Police In The Community Program (PIC) - A downpayment assistance loan program for San Francisco police officers purchasing a first home in San Francisco. Borrowers must provide verification of employment with the SFPD as an officer in good standing. Can be used in the purchase of a BMR unit.

- Mortgage Credit Certificate Program (MCC) - A program to assist first time homebuyers in San Francisco. An MCC assists eligible homebuyers in their ability to qualify for a mortgage loan and reduce thier effective mortgage interest rate. Can be used in the purchase of a BMR unit.

- Reissue Mortgage Credit Certificate Program (RMCC) - IRS regulations allow exisitng recipients of MCCs to refinance their original mortgage loans on their principal residence and obtain a new MCC with a tax credit at the same rate as their original MCC.

- BMR-DALP Downpayment Assistance Program - A downpayment loan program for first time home buyers purchasing a Below Market Rate unit that requires no monthly payment and accrues no interest.

- Refinancing and Subordination - Eligible City loans or Below Market Rate (BMR)...