Government Assistance with mortgage

Risky Business: Government Mortgage Insurance Programs

Risky Business: Government Mortgage Insurance Programs

W. Scott Frame, Kristoper Gerardi, and Joseph Tracy

Homeownership has long been a U.S. public policy goal. One of the many ways that the federal government subsidizes homeownership is through mortgage insurance programs operated by the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the USDA’s Rural Housing Service (RHS). These programs facilitate home financing opportunities for first-time and low- and moderate-income homebuyers. Virtually all of these government-insured mortgages are securitized by Ginnie Mae, a government agency that guarantees the timely payment of principal and interest of these loans to investors that purchase the securities. That is, the U.S. taxpayers assume the credit risk on these mortgages. In this post, we assess the riskiness of these loans.

Although the exact terms and conditions for each government mortgage insurance program are different, a common thread is that their borrower profiles are generally quite risky. These loans are typically characterized by significant leverage and borrowers often have checkered credit histories as evidenced by very low credit scores. For example, the FHA program allows for mortgages with an original loan-to-value (LTV) ratio of up to 96.5 percent; and such loans are also subject to an upfront mortgage insurance premium that is typically rolled into the loan balance, which further raises the initial LTV.

Although the exact terms and conditions for each government mortgage insurance program are different, a common thread is that their borrower profiles are generally quite risky. These loans are typically characterized by significant leverage and borrowers often have checkered credit histories as evidenced by very low credit scores. For example, the FHA program allows for mortgages with an original loan-to-value (LTV) ratio of up to 96.5 percent; and such loans are also subject to an upfront mortgage insurance premium that is typically rolled into the loan balance, which further raises the initial LTV.

The lack of upfront equity implies that FHA mortgage borrowers are at greater risk of default than conventional mortgage borrowers. Highly leveraged borrowers might also be expected to behave like “renters with debt, ” as opposed to “owners with equity, ” and hence not generate the perceived social benefits of homeownership early in the life of the mortgage. These highly leveraged government-insured loans are also typically issued to borrowers with weak to poor credit histories, further increasing the risk of default and foreclosure. Borrowers with poor credit histories are more likely to face adverse income shocks and the combination of negative equity and a high risk of adverse income shocks implies that these mortgages are at high risk of default.

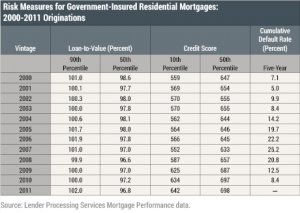

The table below summarizes annual data for Ginnie Mae securitized loans included in the Lender Processing Services (LPS) data that were originated between 2000 and 2011. Before the start of the housing bust in 2007, the median LTV for these loans was generally around 98 percent and the borrower’s median credit score was below 650. More striking is that in several years more than 10 percent of government-insured loans had LTVs over 101 percent and one-quarter were made to borrowers with FICO scores in the low 600s and below.

The table below summarizes annual data for Ginnie Mae securitized loans included in the Lender Processing Services (LPS) data that were originated between 2000 and 2011. Before the start of the housing bust in 2007, the median LTV for these loans was generally around 98 percent and the borrower’s median credit score was below 650. More striking is that in several years more than 10 percent of government-insured loans had LTVs over 101 percent and one-quarter were made to borrowers with FICO scores in the low 600s and below.

In the post-crisis period after 2008, borrower credit scores for Ginnie Mae-securitized mortgages were markedly higher across the board. This evolution likely reflects both supply-side and demand-side factors. On the supply-side, mortgage originators may have established minimum FICO cutoffs in an effort to reduce compliance risk. In the underlying data you clearly see a lower FICO bound of 620 for loans originated after 2008, which suggests this may have been the case. On the demand-side, there was substitution by borrowers with higher credit scores toward government mortgage insurance as the private mortgage insurance industry retrenched by markedly raising premiums and limiting access in the hardest-hit geographic areas.

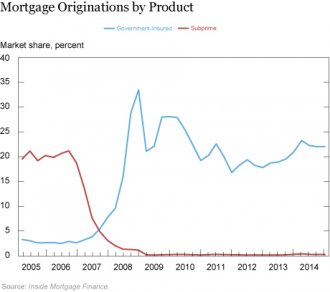

The use of government mortgage insurance programs has varied significantly in recent years. During the housing boom from 2000 to 2005, such loans comprised less than 3 percent of mortgage originations, as the privately insured subprime market accounted for about 20 percent of new loans. However, after the collapse of new subprime lending in 2007, government insurance programs rapidly expanded and more than filled the void. The chart below illustrates these patterns. The market share of government-insured mortgages reached a peak of almost 35 percent in 2009, and has held relatively steady at around 20 percent over the past four years.