Federal Mortgage Programs

The Federal Housing Administration (FHA) operates a guarantee program for single-family mortgages that aims to extend access to homeownership to potential buyers who lack the savings, credit history, or income to qualify for conventional mortgages. Under the program, FHA insures certain mortgages issued by private lenders, in exchange for a fee. If a borrower fails to make a payment or defaults on an insured mortgage, the FHA pays the issuer or holder of the mortgage the amount due. (FHA operates a similar program for mortgages on multifamily residences.)

The Federal Housing Administration (FHA) operates a guarantee program for single-family mortgages that aims to extend access to homeownership to potential buyers who lack the savings, credit history, or income to qualify for conventional mortgages. Under the program, FHA insures certain mortgages issued by private lenders, in exchange for a fee. If a borrower fails to make a payment or defaults on an insured mortgage, the FHA pays the issuer or holder of the mortgage the amount due. (FHA operates a similar program for mortgages on multifamily residences.)

CBO receives many questions about the budgetary cost or savings of this program. Most recently, we have received some questions concerning the $1.7 billion cash infusion FHA received from the Treasury on September 30, 2013. So, we thought it would be helpful to pull together our answers to some of those questions. The following paragraphs discuss the costs of FHA’s single-family program. Tomorrow, we will follow up with another blog post that explains the operation of the fund that records the program’s financial transactions, including the recent $1.7 billion infusion.

Tomorrow, we will follow up with another blog post that explains the operation of the fund that records the program’s financial transactions, including the recent $1.7 billion infusion.

Has FHA’s Guarantee Program for Single-Family Mortgages Produced Net Savings to Taxpayers?

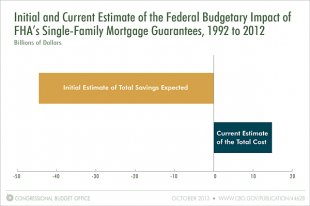

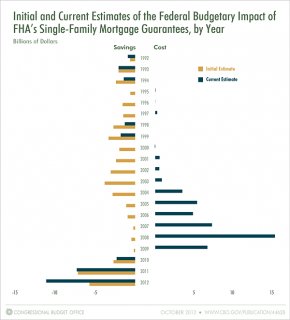

No. Collectively, the single-family mortgage guarantees made by FHA between 1992 and 2012 have had a net federal budgetary cost of about $15 billion, according to the most recent estimates by FHA. In contrast, FHA’s initial estimates of the budgetary impact of those guarantees sum to savings of $45 billion (see the figure below). That swing of $60 billion from savings to cost primarily reflects higher-than-expected defaults by borrowers and lower-than-expected recoveries when the houses of defaulted borrowers have been sold—especially for loans made over the 2004-2009 period.

Those estimates of net budgetary impact were calculated using the methodology established by the Federal Credit Reform Act of 1990 (FCRA), which is discussed below. Under that methodology, the estimated costs or savings associated with FHA’s mortgage guarantees can change each year until the mortgages are repaid, refinanced, or otherwise closed out (such as through a payout on a default).